Onchain finance’s next phase may be defined by infrastructure— not apps

As the digital-asset sector matures, the narrative that dominated its early years—rapid experimentation at the application layer—appears to be giving way to a more familiar institutional arc: standards, shared infrastructure, and “capital-grade” usability. In that transition, a cluster of activity tied to Coinbase’s ecosystem and Base has become a focal point for a different question than the one that powered the first wave of DeFi: not “What new products can be built?” but “What financial architecture can scale?”

DeFi’s constraint is often structural, not technical

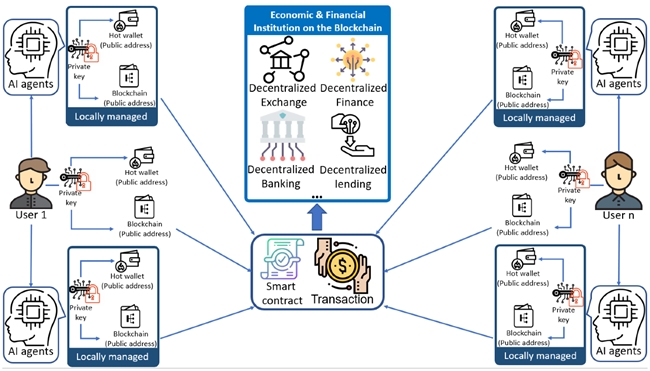

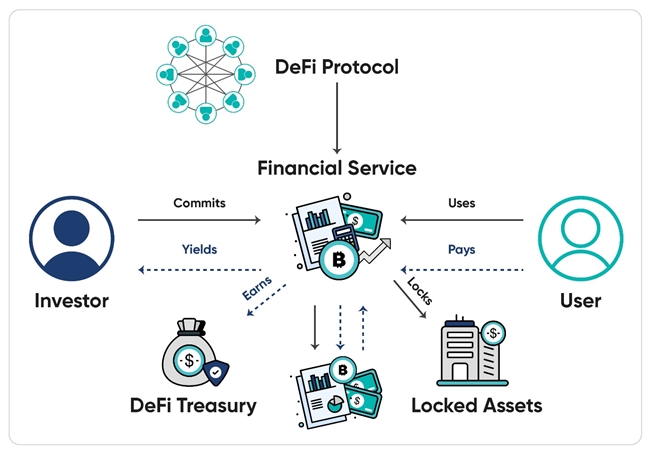

Decentralized finance has proven it can ship features quickly—automated market making, lending, derivatives, and an expanding universe of yield strategies. Yet the sector’s deployable scale has not consistently matched its technical sophistication. A recurring limiting factor is not yield or creativity, but where complexity sits in the system.

In traditional finance, complexity is heavily absorbed by institutions: risk teams, compliance frameworks, strategy construction, and operational controls are largely handled “behind the scenes.” By contrast, onchain finance has frequently exposed that complexity directly to end users. When strategy selection, risk understanding, and operational decision-making are pushed to the edge of the network, participation can skew toward sophisticated operators while risk-sensitive pools of capital remain cautious.

This is a structural mismatch: a system that is technically open, but operationally demanding, can struggle to support the kind of large-scale, repeatable allocation behavior that defines mature financial markets.

Coinbase’s “gateway” thesis and Base’s role

Within this framing, Base can be read less as a performance-driven Layer 2 and more as a usability and distribution play. The pitch is straightforward: inherit Ethereum’s security assumptions while reducing transaction costs enough to make higher-frequency and more complex financial workflows economically viable.

The differentiator frequently cited by Base proponents is not only technical characteristics, but proximity to a large, globally distributed user base and a regulated on-ramp ecosystem. In this view, Base functions as an execution backend for onchain financial activity—an environment where cost and friction are low enough for automation, strategy rebalancing, and composable routing to be practical at scale.

B18 as a coordination layer, not a single DeFi product

If Base is the execution layer, the next architectural question becomes: what sits above it to coordinate risk, strategy, and capital flows in a way that is reusable and machine-operable?

That is the niche the document assigns to B18—described not as a retail-facing DeFi application, but as a structured coordination layer designed around capital needs rather than user interaction. Instead of emphasizing one strategy or one interface, the intent is to “protocolize” yield sources and risk parameters, reduce reliance on human discretion in execution, and enable composition across different capital demands.

In practical terms, this resembles middleware for onchain asset management: a place where strategies can be expressed, orchestrated, and consumed by other systems rather than hand-operated by individuals.

Why interface standards matter: from ERC-4626 to “financial semantics”

Standardization is often what turns a collection of products into an ecosystem. In DeFi, ERC-4626 was a milestone because it normalized vault interfaces—making deposits and withdrawals more consistent across implementations. But real-world financial operations tend to require more than standardized input/output. Interpretable strategy descriptions, readable risk parameters, and programmable distribution logic are critical if capital allocators, wallets, and institutional tooling are to interact with onchain products safely and repeatedly.

The document frames B4626 as an attempt to extend the vault standard into a higher-order “financial language,” adding machine-readable strategy description, risk parameters that other systems can interpret, and yield routing that can be configured programmatically rather than manually.

This shift matters because it changes what a “vault” is. Instead of a simple container for assets, a vault becomes a modular financial component that other protocols and software stacks can integrate, analyze, and reuse.

How standards spread: distribution, not persuasion

Technical standards rarely win through education campaigns alone. More often, they become defaults because they sit on a path of capital efficiency: builders adopt them to access liquidity, distribution, or integration surfaces that would otherwise be costly to reach.

Here, the document argues that B18’s internal design makes B4626 effectively mandatory for those who want to plug into its strategy and distribution network, because B18’s native strategies and external interfaces default to B4626 outputs. The consequence, if adoption grows, is that B4626 could evolve into a de facto standard through usage rather than marketing.

Why this moment: three trends converging

The broader “why now” case rests on overlapping trends:

1.Capital that is compliant—or moving toward compliance—is actively exploring ways to deploy onchain.

2.Ethereum Layer 2 networks are increasingly treated as execution venues for financial activity rather than niche scaling solutions.

3.Baseline standards exist, but higher-order financial semantics remain under-specified.

If those forces continue, the winning architectures may not be the most novel consumer apps, but the systems that make complex onchain finance legible, automatable, and operationally safe for repeated use.

A longer-term map: toward an onchain “operating system” for finance

The document’s long-horizon view suggests an emerging division of labor: Coinbase as an access and distribution gateway, Base as an execution environment, and a protocol layer—represented here by B18 and B4626—that absorbs and expresses financial complexity in reusable form.

If that model holds, the scarce resource in the next phase of onchain finance may not be the highest short-term yield, but the standards and infrastructure that reduce user burden and make capital deployment repeatable. In other words, the shift is from individuals managing complexity to protocols managing it—an evolution that mirrors the maturation path of traditional financial systems, translated into programmable networks.